Navigating the Intersection of Finance and Technology: JPMorgan Chase’s Bitcoin Policy and the Role of AI

Artificial Intelligence (AI) has become a transformative force across industries, fundamentally reshaping how businesses operate, innovate, and engage with customers. In the context of JPMorgan Chase’s evolving stance on Bitcoin, exploring AI’s role offers unique insights into the financial sector’s adaptation to emerging technologies and complex market behaviors.

AI and the Evolution of Financial Services

The financial industry, long reliant on data-driven decision-making, has embraced AI to enhance risk assessment, customer service, fraud detection, and trading strategies. JPMorgan Chase, as a leading global institution, leverages AI to analyze vast data streams—ranging from market trends to customer transactions—enabling more informed and agile responses to rapid changes like the rise of cryptocurrencies.

AI’s ability to process unstructured data such as social media sentiment, news reports, and blockchain activity equips banks to gauge market sentiment about assets like Bitcoin more accurately. This analytical depth helps institutions manage volatility and client demand with greater precision, potentially mitigating some risks tied to digital currencies.

Supporting Crypto Integration with AI-Driven Risk Management

JPMorgan’s decision to allow Bitcoin purchases without offering custody aligns with a cautious risk posture, wherein AI can play a pivotal supporting role. Advanced AI models can predict fraud patterns, detect anomalies in cryptocurrency transactions, and identify regulatory compliance issues before they escalate. This sophisticated oversight is vital, given the decentralized, pseudonymous nature of cryptocurrencies that complicates traditional banking safeguards.

Moreover, AI can assist in portfolio optimization by simulating various investment scenarios involving crypto assets, enabling both the bank and its clients to make data-backed decisions. As direct custody remains outsourced, AI-driven monitoring tools can continuously evaluate third-party custodians’ performance and security, supporting JPMorgan’s risk mitigation strategy.

Reconciling Contradictions Through AI Insights

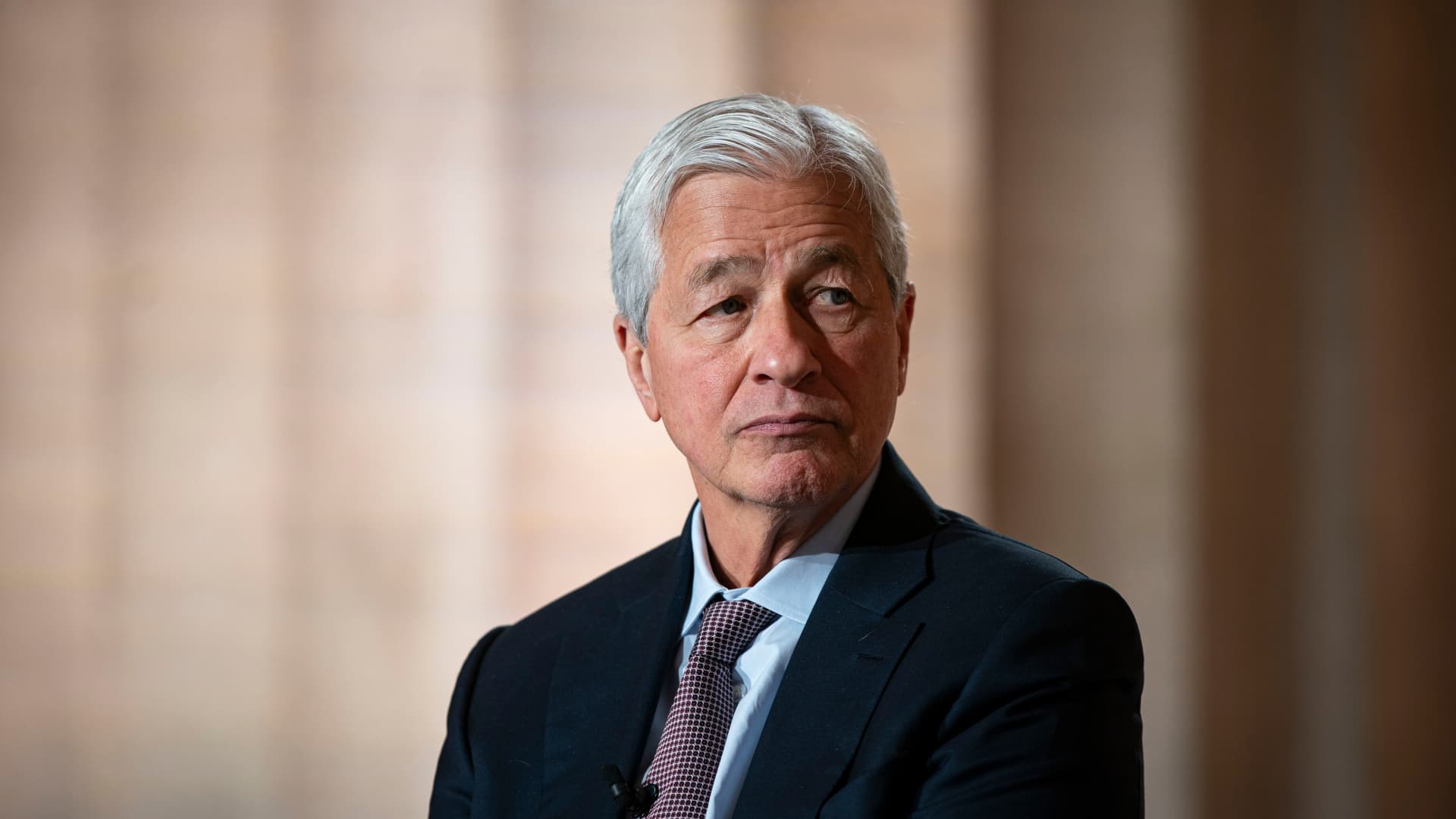

Jamie Dimon’s skepticism about Bitcoin versus JPMorgan’s corporate strategy epitomizes the tension between caution and innovation—a balance AI can help achieve. By providing objective, data-based assessments rather than subjective judgments, AI supports informed decision-making that respects both individual caution and client interests.

For example, AI-powered sentiment analysis and predictive analytics can identify shifts in client behavior or emerging regulatory risks early, allowing the bank to adjust offerings proactively. This dynamic approach reduces the gap between executive skepticism and market realities, fostering a more agile corporate strategy.

AI’s Role in Shaping the Future Financial Ecosystem

The gradual integration of cryptocurrencies in traditional finance is part of a broader technological convergence, where AI and blockchain technologies influence each other’s development. AI tools enhance blockchain scalability and security through pattern recognition and anomaly detection, while blockchain’s transparency improves AI data authenticity and traceability.

JPMorgan’s engagement with Bitcoin, tempered by AI-enabled risk controls, exemplifies a forward-leaning yet measured approach that other institutions are likely to emulate. As AI continues to evolve, it will underpin increasing automation, compliance, and innovation, enabling banks to incorporate digital assets more seamlessly into client portfolios.

Challenges Ahead: AI Limitations and Ethical Considerations

Despite AI’s promise, challenges remain in fully harnessing its potential within cryptocurrency integration. AI models depend on data quality and transparency, which can be problematic in the fragmented crypto ecosystem. In addition, reliance on AI raises ethical questions around algorithmic bias, data privacy, and decision accountability—areas that banks like JPMorgan must navigate carefully to preserve trust.

Regulatory frameworks around AI in finance are still developing, potentially complicating adoption and deployment. Furthermore, unpredictable market events and black-swan scenarios can elude even the most sophisticated AI systems, necessitating ongoing human oversight alongside automated processes.

A Strategic Partnership Between AI and Finance

JPMorgan Chase’s cautious yet progressive step into Bitcoin resonates with the broader theme of AI empowering traditional finance to evolve responsibly. AI’s analytical rigor helps reconcile skepticism with opportunity, enabling institutions to serve clients’ crypto interests without forsaking prudence.

This synergy between AI and finance exemplifies how technological innovation, tempered by strategic caution, can redefine investment landscapes. As JPMorgan tests the waters of digital assets, AI will be a critical tool in navigating uncertainties and unlocking new growth frontiers.

Conclusion: The Calculated Harmony of AI and Crypto in Modern Banking

The intersection of AI and cryptocurrencies, as demonstrated by JPMorgan Chase’s approach to Bitcoin, highlights a transformative epoch in finance. AI’s capacity to analyze complexity, manage risk, and enhance decision-making offers a pragmatic pathway for banks confronting volatile digital assets, bridging the divide between skepticism and adoption.

As the financial ecosystem matures, institutions that strategically integrate AI with emerging technologies like blockchain will steer the future of investing, innovation, and client engagement. JPMorgan’s deliberate embrace of Bitcoin access—and the AI tools underpinning that move—signal a sophisticated, evolving financial landscape where prudence and progress coexist dynamically.