The Role of AI in Shaping the Latest Stock Market Movements

Artificial intelligence (AI) has emerged as a dynamic force influencing various sectors of the stock market, interweaving innovation, investor expectation, and strategic growth. While the recent midday trading surge spotlighted companies like D-Wave Quantum, Moderna, Agilysys, and Tesla, AI plays an often understated yet pivotal role in their market narratives. Understanding AI’s presence, both as a direct business driver and a complementary catalyst, enriches the comprehension of these market shifts and offers insights into future investment directions.

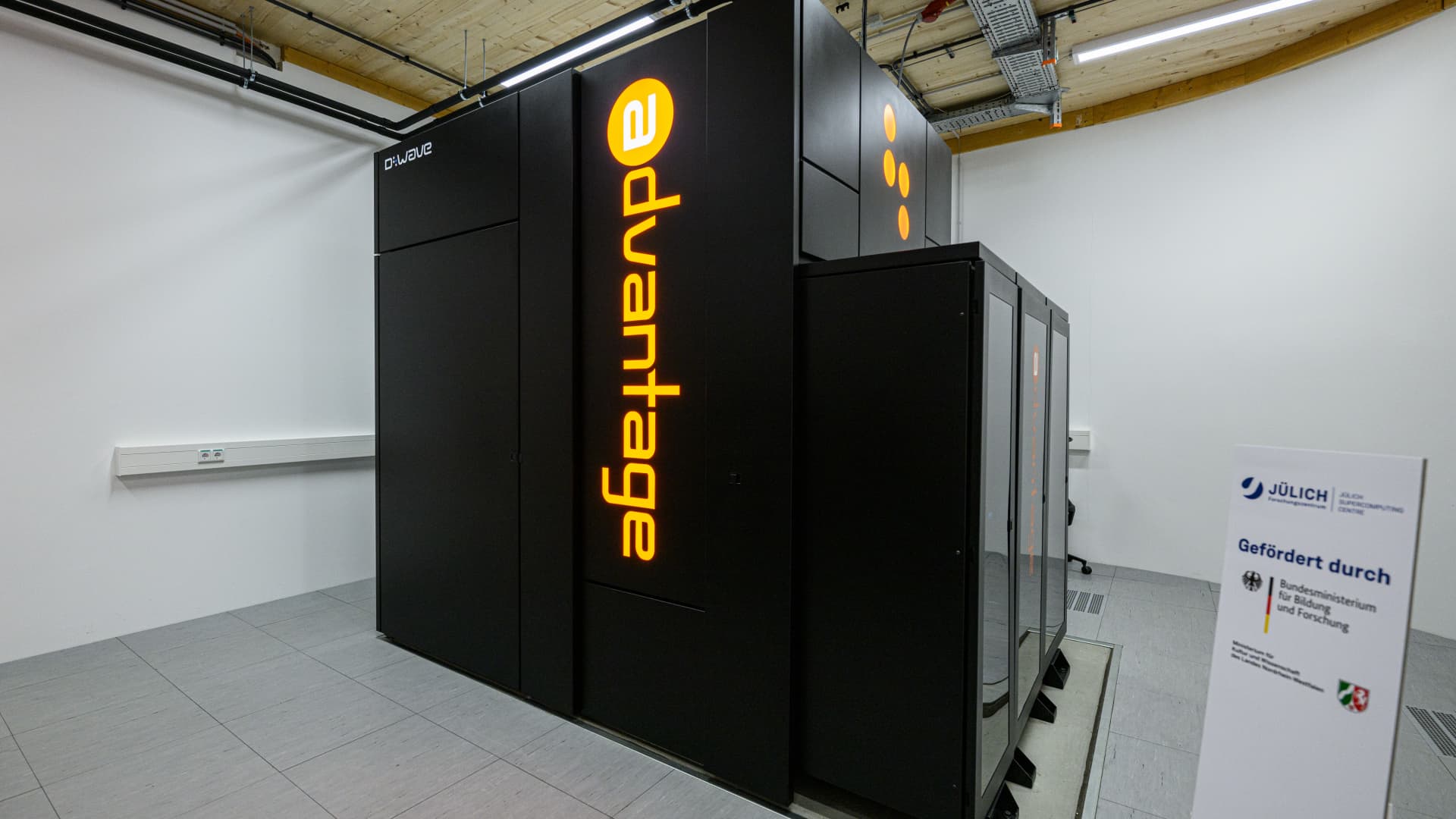

AI as a Catalyst in Quantum Computing Advances

D-Wave Quantum’s striking ascent is tightly linked not only to its strides in quantum computational supremacy but also to its integration of AI technologies. The company’s emphasis on exploiting synergies between quantum computing and artificial intelligence highlights a groundbreaking frontier where AI algorithms benefit immensely from quantum acceleration.

– Enhanced Problem-Solving: Quantum systems can potentially supercharge AI models, enabling solutions to complex optimization challenges that classical computers struggle with.

– Market Optimism: Investors recognize the dual innovation — advancing quantum hardware while facilitating AI applications — as a powerful value proposition that could redefine industries from logistics to pharmaceuticals.

This fusion makes AI more than a buzzword; it’s a substantial element shaping investor belief in D-Wave’s growth trajectory and, more broadly, the quantum computing sector.

AI’s Influence in Biotech and Pharma Markets

Moderna’s stock momentum also reflects AI’s rising impact in the biopharmaceutical arena. AI-driven drug discovery and development are revolutionizing how companies approach vaccine design, clinical trials, and predictive analytics.

– Accelerated Innovation: AI models enable Moderna to optimize mRNA sequences and forecast therapeutic efficacy faster, shortening traditionally lengthy development cycles.

– Investor Sentiment: Positive regulatory milestones are complemented by confidence in Moderna’s leveraging of AI to maintain a competitive edge, bolstering the volatility and growth in its share price.

Here, AI acts as both a technological enabler and a narrative enhancer, intensifying market responses to regulatory news and innovation milestones.

AI Integration in Sector-Specific Growth Stories

Companies like Agilysys illustrate AI’s growing footprint in more specialized sectors such as hospitality management. By deploying AI-powered software solutions, Agilysys improves operational efficiency for hotels and leisure facilities, translating into stronger financial performance and investor appeal.

– Digital Transformation Driver: AI facilitates predictive analytics and customer experience enhancements, reinforcing Agilysys’s value proposition amid increasing demand for tech-driven hospitality solutions.

– Stock Gains Contextualized: The stock uplifts in such companies reflect market appreciation for AI’s practical impact on traditional industries adapting to digital trends.

Similarly, Tesla’s innovation narrative is inseparable from AI, particularly in its leadership of autonomous driving technologies and energy management systems. CEO Elon Musk’s commitment reassures investors that Tesla’s AI-driven ventures will remain a strategic focus.

AI Amid Broader Market Dynamics

In the wider market environment, AI’s role manifests through sector rotations and investment flows into technology-heavy stocks. While some sectors witness selloffs despite strong earnings, AI-powered companies often attract sustained interest:

– Selective Buying: Investors gravitate towards firms demonstrating tangible AI integration, whether in quantum computing, biotech, or automotive technology, as a bet on future growth.

– Strategic Partnerships: Collaborations involving AI giants like Microsoft and emerging quantum startups underscore the strategic importance of AI in driving innovation investment.

This selective enthusiasm suggests market participants are discerning about AI’s direct versus speculative value, focusing on companies delivering concrete AI applications.

Looking Ahead: AI as a Market-Moving Force

AI’s infusion into multiple facets of the stock market movement reveals it as a core driver behind technology investment themes. From D-Wave Quantum’s quantum-AI synergy to Moderna’s AI-enhanced development pipeline, and from sector-specific digital transformations at Agilysys to Tesla’s autonomous ambitions, AI shapes narratives that resonate deeply with investors.

Recognizing AI’s multifaceted role empowers investors and market watchers to decode price surges more effectively and anticipate emerging trends. As AI technologies mature and embed themselves across industries, the interplay between innovation and financial markets will only intensify, continuously redefining where smart capital flows.