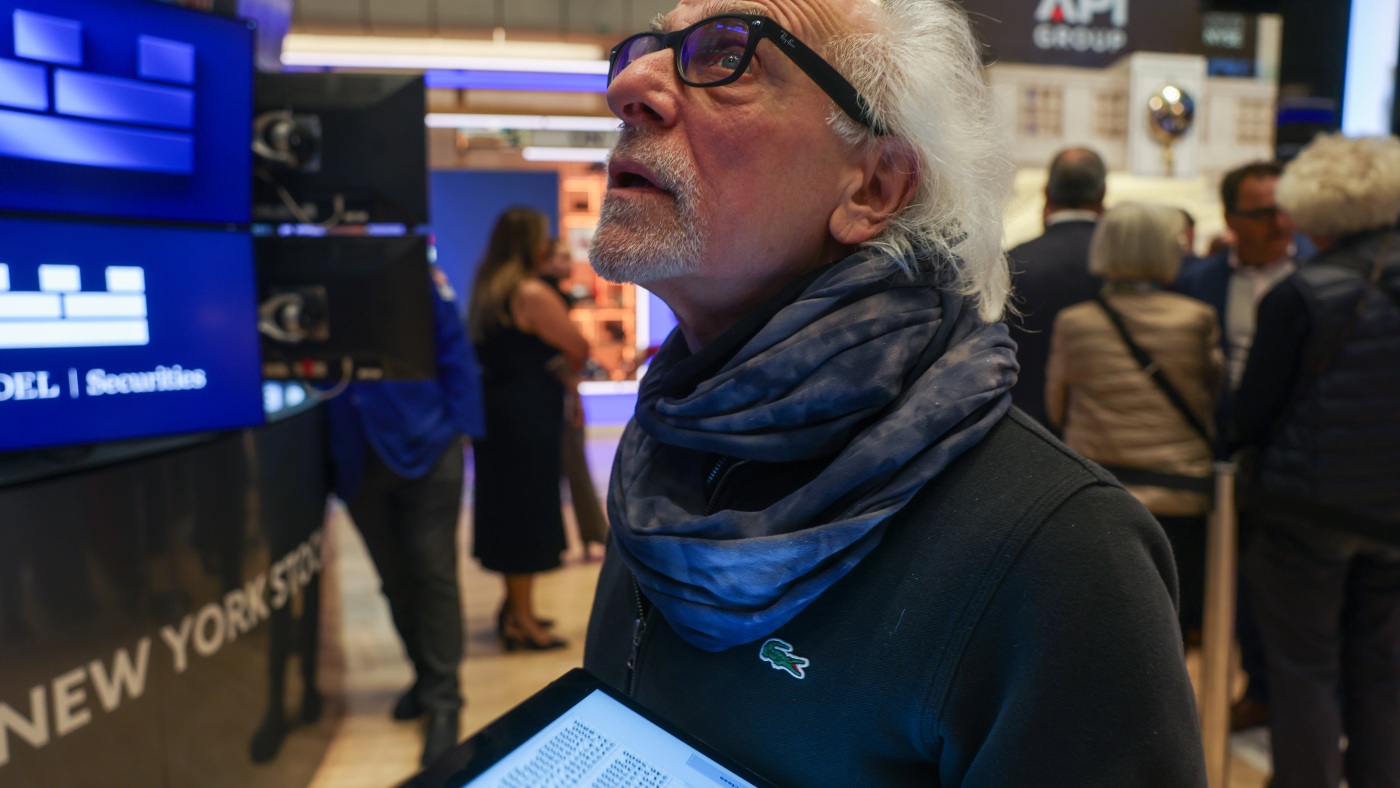

Analyzing the “Sell America” Trend: Unpacking Investor Sentiment and Market Dynamics

Decoding a New Investor Behavior

In recent weeks, Wall Street has witnessed an unsettling pattern: an accelerated movement away from U.S. government bonds and related financial instruments. This “Sell America” trend captures a broadened reassessment of risk, where assets once deemed the gold standard of safety now evoke caution and skepticism among investors. Understanding this market sentiment shift requires unraveling the economic and political threads that have frayed investor confidence and reshaped perceptions about one of the world’s largest financial ecosystems.

Drivers Behind the Sell-Off

Risk Recalibration in U.S. Markets

The foundational appeal of U.S. Treasuries has long been their near-guaranteed stability rooted in America’s economic might and political stability. However, perceptions have evolved due to heightened uncertainties—both political and fiscal. Investors now grapple with the reality that America’s once-unchallenged status as a secure investment refuge is under scrutiny, influenced by shifting domestic priorities and global geopolitical tensions.

The Moody’s Credit Downgrade: A Wake-Up Call

Moody’s decision to downgrade the U.S. credit rating injected a fresh dose of alarm into the markets. This downgrade is more than a mere rating adjustment; it reflects skepticism about the government’s trajectory in managing its swelling national debt and deficits. Such skepticism reverberates across financial markets by increasing perceived risk premiums, nudging investors to reassess the balance between risk and reward in U.S. securities.

Political and Economic Turmoil Amplifying Market Concerns

Trade wars, especially those ignited by recent tariff policies, and political discord impacting Federal Reserve independence have unsettled the traditional equilibrium of market confidence. The unpredictability related to tariff negotiations, economic slowdowns, and political pressures on monetary authorities has fed into a broader climate of uncertainty—conditions that encouraged portfolio reallocation away from U.S. assets.

Ripple Effects on Markets

Bond Market Consequences

As sell orders intensify, bond prices decline and yields climb, heightening the cost of borrowing for the U.S. government. This domino effect raises apprehensions about the sustainability of fiscal health and inflationary pressures, which in turn affects credit conditions throughout the economy.

Volatility in Equities

Stock markets have mirrored bond market turbulence with increased volatility, driven by concerns over trade disputes and economic outlooks. The simultaneous pressure on both bonds and stocks highlights a systemic risk-off environment rather than isolated asset class weakness.

Weakening U.S. Dollar Dynamics

The dollar’s depreciative movements signify waning foreign demand, which can influence trade balances and investment flows. This development potentially signals a recalibration of the dollar’s unparalleled global dominance.

Global Repercussions: Redefining Economic Influence

The “Sell America” wave extends its implications beyond U.S. borders. The trend challenges the traditional financial hegemony of the U.S.:

– Diversification of Global Reserves

Nations and institutional investors are increasingly pursuing diversification strategies to hedge against risks tied to American financial instruments.

– Threats to the Dollar’s Reserve Currency Role

Reduced confidence in U.S. assets could precipitate shifts away from the dollar-centric international trade and finance systems, altering geopolitical balances.

– Complications for U.S. Fiscal and Monetary Management

Heightened borrowing costs constrain government policy flexibility, influencing social, defense, and economic policies.

Navigating Forward: Steps Toward Reassurance

Reestablishing Fiscal Discipline

Mitigating risk perceptions necessitates transparent and sustainable debt management complemented by fiscal rigor.

Promoting Predictable Monetary Policy

Insulating the Federal Reserve from political conflicts and ensuring consistency in monetary strategies are vital to calming investors.

Resolving Trade and Diplomatic Uncertainties

Engaging in constructive international negotiations can reduce volatility and restore broader economic stability.

A Turning Point for Market Confidence

The emerging “Sell America” phenomenon is more than a temporary market bout; it signals a pivotal juncture where structural economic and political factors converge to challenge the United States’ financial supremacy. Restoring faith among domestic and international investors demands deliberate, balanced strategies that address fiscal health, political steadiness, and global cooperation. Success in these areas will determine whether America can maintain its role as a cornerstone of global finance or face a fundamental realignment in economic leadership.