Riding the Crypto Wave: Decoding Fear and Greed

In the wild world of cryptocurrency, where fortunes are made and lost in the blink of an eye, merely understanding the tech or crunching numbers isn’t enough. You’ve got to get a handle on the *vibes*. Enter the Crypto Fear & Greed Index, a trusty tool that helps you gauge the emotional temperature of the crypto market. Is everyone panicking and selling? Or are they throwing caution to the wind, blinded by the promise of massive gains? Let’s break down what the index is all about, how it works, and how you can use it to make smarter moves.

What’s the Big Idea? Tapping Into Crypto’s Emotional Core

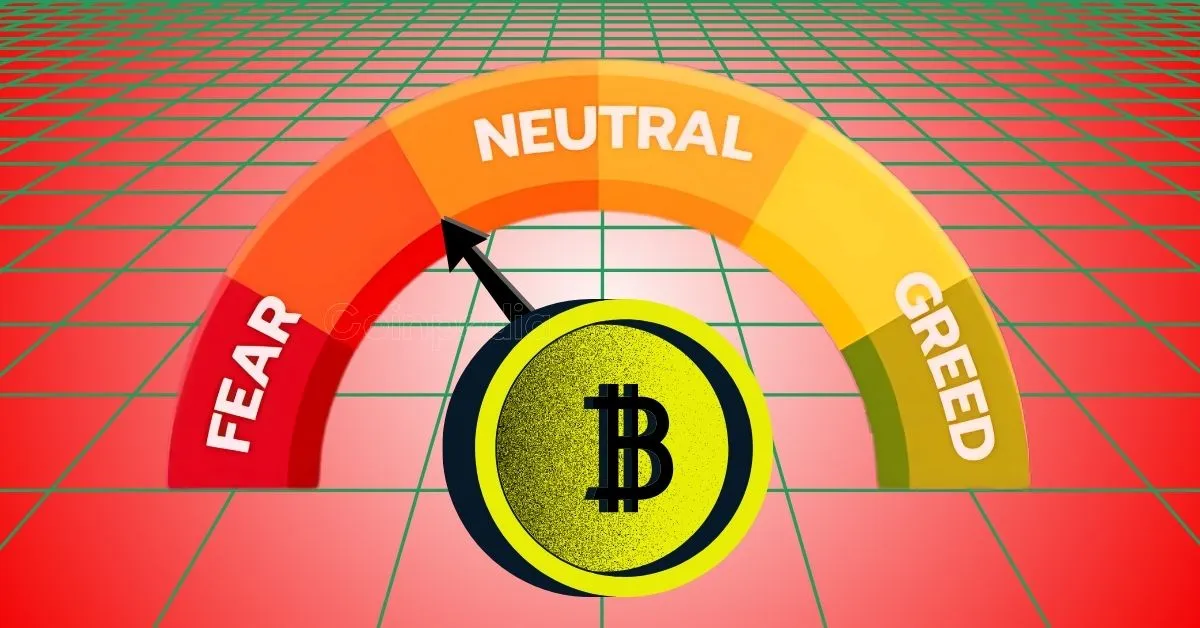

Think of the Crypto Fear & Greed Index as a mood ring for the crypto market, particularly tuned to Bitcoin but often reflecting the whole digital shebang. The core idea is simple: fear and greed drive the market. When people are scared, they sell, prices drop, and you might have a golden opportunity to buy low. When everyone’s greedy, they buy, prices soar, and you might want to think about cashing in before the bubble bursts.

The index runs on a scale from 0 to 100. Zero screams “Extreme Fear!” – think widespread panic and potentially undervalued assets. One hundred shouts “Extreme Greed!” – picture irrational exuberance and a high risk of a market correction. This concept isn’t some crypto-specific invention. Traditional finance has long recognized that emotions play a huge role in how assets are priced. The Crypto Fear & Greed Index just tailors this idea to the unique, often chaotic world of crypto, where news, social media buzz, and regulatory announcements can send the market on a rollercoaster ride in no time.

The Secret Sauce: How the Index is Mixed

The Crypto Fear & Greed Index isn’t based on just one thing. It’s a special blend of various market factors, all stirred together to give you a sense of the overall market mood. While different providers like Alternative.me, Binance, and CoinMarketCap might tweak the recipe, the ingredients are generally the same:

- Volatility: Big price swings, whether up or down, are a sign of heightened emotions. The more volatile things are, the more likely the index is to swing to extremes.

- Market Momentum/Volume: Lots of buying and high trading volumes usually mean greed is in the air. Panic selling and low volumes, on the other hand, suggest fear is taking over.

- Social Media Buzz: What are people saying on Twitter (now X), Reddit, and other social media platforms? By analyzing the tone of these conversations, the index can get a sense of whether people are generally optimistic or pessimistic about crypto.

- Surveys: Some index providers even ask crypto investors directly about their feelings through polls and surveys.

- Bitcoin’s Dominance: If Bitcoin’s share of the overall crypto market is rising, it could mean people are flocking to the relative safety of Bitcoin during uncertain times.

- Market Hype: How much are people talking about crypto in general? By tracking search trends and news coverage, the index can gauge the level of excitement and hype surrounding the market.

Binance Square drops hints that they’re using trading data and unique user behavior insights for a more precise overview, suggesting they’re diving into stuff like on-chain analytics and real-time trading patterns. CoinGlass highlights the analysis of “multiple market factors” to determine the emotional state of participants. Essentially, the index is trying to capture a complete picture of market sentiment by looking at all sorts of different data points.

Putting It to Work: How to Use the Index Like a Pro

The Crypto Fear & Greed Index isn’t a magic lamp, but it can be a valuable tool to make smarter decisions. Here’s how you can put it to work:

- Go Against the Grain (Contrarian Investing): One of the most common ways to use the index is as a contrarian indicator. When the index shows extreme fear (a low score), it might be a good time to buy, because assets are likely undervalued. When the index shows extreme greed (a high score), it might be time to sell or at least be cautious, because the market might be due for a correction.

- Double-Check Your Gut (Confirmation of Technical Analysis): Use the index to confirm what you’re seeing in technical charts. If a technical indicator suggests a potential price reversal, a low Fear & Greed Index score could strengthen the case for a bullish outlook.

- Manage Your Risk (Risk Management): Your emotions may not give you an accurate outlook. Understanding market sentiment can help you adjust your risk exposure. During periods of extreme greed, it might be smart to dial back the risk in your portfolio. During periods of extreme fear, you might consider a more aggressive investment strategy.

- Spot the Turns (Identifying Market Cycles): The index can sometimes help you spot potential turning points in the market cycle. Extreme fear often lines up with the bottom of a bear market, while extreme greed can signal the top of a bull market.

- Seize the Moment (Short-Term Trading): Traders can use the index to get a sense of short-term market momentum and identify potential quick-hit trading opportunities.

Mudrex emphasizes the index’s usefulness in “timely decision-making for buying and selling opportunities,” while CoinMarketCap highlights its ability to help investors “stay ahead of market trends.”

Stay in the Know: Real-Time Access

One of the best things about the Crypto Fear & Greed Index is that it’s easily accessible and updated in real-time. Platforms like CoinStats and Cointree provide live data, often updated every few minutes. The availability of historical data also lets you study past market cycles and spot recurring patterns. The presence of a dedicated Twitter account (@BitcoinFear), further demonstrates the index’s commitment to real-time dissemination of information.

A Word of Caution: Limitations

Even though the Crypto Fear & Greed Index is a helpful tool, it’s not perfect.

- It’s a Feeling Thing (Subjectivity): Even though the index uses numbers, interpreting sentiment is still somewhat subjective.

- Fake It Till You Make It (Manipulation): Social media sentiment can be manipulated, which could throw off the index.

- Looking Back, Not Forward (Lagging Indicator): The index often reflects past sentiment rather than predicting future movements.

- Don’t Go It Alone (Not a Standalone Tool): Don’t rely on the index alone. It’s best used in combination with other types of analysis, like technical analysis and fundamental research.

Your Crypto Compass

The Crypto Fear & Greed Index is a nifty gadget to have on your crypto journey. By measuring the emotional state of investors, it gives you a different view and helps you spot possible chances and dangers. While it’s not a foolproof way to predict what the market will do, it’s a vital part of a well-thought-out investing plan. It helps traders and investors steer through the tricky crypto world with more awareness and confidence. Its easy-to-get data, real-time updates, and thorough method make it a crucial tool for anyone wanting to truly understand the forces that move crypto prices.