Uber’s Q1 2025 Financial Performance: A Closer Look

Introduction: A Tale of Two Metrics

Uber’s first-quarter 2025 financial results tell a story of contrasts—strong user growth and operational efficiency paired with a revenue shortfall. The company’s ability to attract riders and streamline costs is undeniable, yet Wall Street’s reaction was lukewarm due to missed top-line expectations. This analysis unpacks the nuances behind Uber’s performance, exploring what’s driving its wins and where challenges lurk beneath the surface.

—

Revenue vs. Earnings: The Divergence

The $90 Million Gap

Uber posted $11.53 billion in revenue, a 13.8% year-over-year increase but $90 million shy of analyst forecasts. This miss raises questions about pricing strategies, market saturation, or external pressures like regulatory costs. Yet, the company’s earnings per share (EPS) of $0.83 crushed expectations ($0.50), signaling that cost-cutting and operational tweaks are paying off.

Profitability Leaps Forward

Adjusted EBITDA surged 35% to $1.9 billion, with the margin expanding to 4.4% of gross bookings. Income from operations skyrocketed from $172 million to $1.2 billion—a clear win for efficiency initiatives. This suggests Uber is mastering the art of *doing more with less*, even as revenue growth moderates.

—

Growth Engines: Where Uber Is Thriving

Riders and Trips Hit Record Highs

– 3.04 billion trips in Q1, up 18% YoY.

– Monthly Active Platform Consumers (MAPCs) grew 14%, proving retention strategies work.

This metric is Uber’s crown jewel: more users and more frequent rides signal sticky demand, even in a competitive market.

Segment Breakdown: Mobility and Delivery Shine

Mobility (Ride-Hailing)

Revenue rose 15% YoY, fueled by post-pandemic shifts toward services (e.g., commuting, events) and global expansion. Key markets like Latin America and India saw double-digit trip growth.

Delivery (Uber Eats)

An 18% revenue jump shows food delivery isn’t just a pandemic fad. Uber’s investments in quick-commerce (e.g., 15-minute grocery delivery) are gaining traction, though margins remain thinner than ride-hailing.

—

Headwinds: The Clouds on the Horizon

Revenue Miss: Why It Matters

The $90 million shortfall, while small relative to total revenue, hints at underlying pressures:

– Competition: Lyft’s aggressive pricing and regional players (e.g., Bolt, Ola) chipping away at market share.

– Regulatory Costs: New driver benefits laws in California and Europe squeezing margins.

External Disruptions

Wildfires in Los Angeles and extreme weather in the South temporarily dented demand. Such events are becoming frequent enough to factor into long-term forecasting.

—

Strategy Check: Betting on Autonomy and Efficiency

Autonomous Vehicles: The Long Game

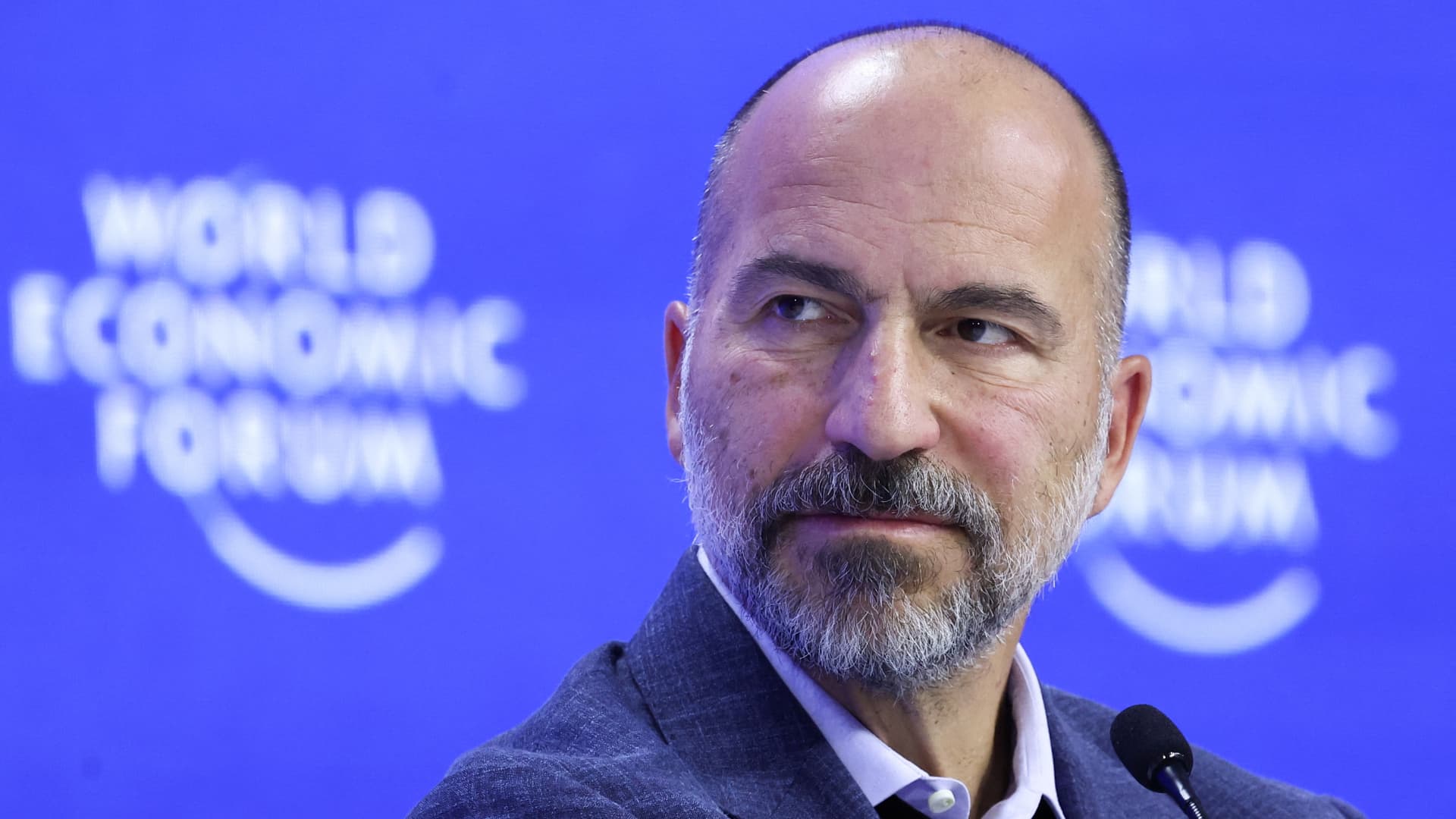

CEO Dara Khosrowshahi doubled down on self-driving tech, calling it a “game-changer for unit economics.” Partnerships with Waymo and in-house R&D aim to reduce driver costs—Uber’s largest expense. But progress is slow, and regulatory hurdles loom.

Operational Tightening

From algorithm-driven route optimization to dynamic pricing, Uber’s tech stack is increasingly focused on margin expansion. Even delivery logistics are getting smarter, with AI predicting peak demand windows.

—

Conclusion: Balancing Act Ahead

Uber’s Q1 2025 results reveal a company at a crossroads. Its ability to grow users and trips is impressive, but revenue pressures and external shocks demand agility. The path forward hinges on three pillars:

For investors, the message is clear: Uber is no longer a growth-at-all-costs startup. It’s a maturing giant learning to walk the tightrope between scale and sustainability. The next few quarters will test whether it can stay balanced.

—